This post is by Phil Price, not Andrew.

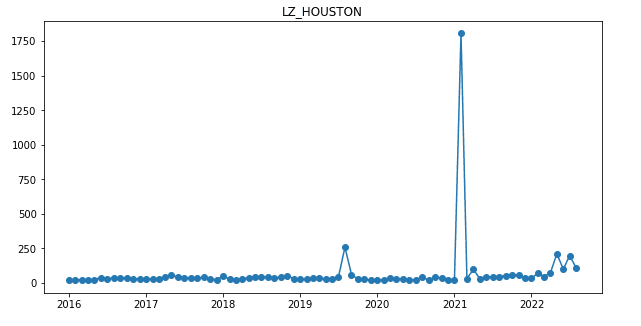

I have a client company that owns refrigerated warehouses around the world. A refrigerated warehouse is a Costco-sized building that is kept very cold; 0 F is a common setting in the U.S. (I should ask what they do in Europe). As you might expect, they have an enormous electric bill — the company as a whole spends around a billion dollars per year on electricity — so they are very interested in the cost of electricity. One decision they have to make is: how much electricity, if any, should they purchase in advance? The alternative to purchasing in advance is paying the “real-time” electricity price. On average, if you buy in advance you pay a premium…but you greatly reduce the risk of something crazy happening. What do I mean by ‘crazy’? Take a look at the figure below. This is the monthly-average price per Megawatt-hour (MWh) for electricity purchased during the peak period (weekday afternoons and evenings) in the area around Houston, Texas. That big spike in February 2021 is an ice storm that froze a bunch of wind turbines and also froze gas pipelines — and brought down some transmission lines, I think — thus leading to extremely high electricity prices. And this plot understates things, in a way, by averaging over a month: there were a couple of weeks of fairly normal prices that month, and a few days when the price was over $6000/MWh.

If you buy a lot of electricity, a month when it costs 20x as much as you expected can cause havoc with your budget and your profits. One way to avoid that is to buy in advance: a year ahead of time, or even a month ahead of time, you could have bought your February 2021 electricity for only a bit more than electricity typically costs in Texas in February. But events that extreme are very rare — indeed I think this is the most extreme spike on record in the whole country in at least the past thirty years — so maybe it’s not worth paying the premium that would be involved if you buy in advance, month after month and year after year, for all of your facilities in the U.S. and Europe. To decide how much electricity to buy in advance (if any) you need at least a general understanding of quite a few issues: how much electricity do you expect to need next month, or in six months, or in a year; how much will it cost to buy in advance; how much is it likely to cost if you just wait and buy it at the time-of-use rate; what’s the chance that something crazy will happen, and, if it does, how crazy will the price be; and so on.

Continue reading Here’s some things that have been going on with Stan since the

Here’s some things that have been going on with Stan since the